Use Your HSA/FSA Funds to Start Sleeping Better

Save an average of 30% on BedJet when using HSA/FSA funds

BedJet has partnered with Flex to enable check out with your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you may be able to use your HSA or FSA debit card to buy our products with pre-tax dollars.

HSA/FSA PAYMENTS SIMPLIFIED WITH flex

You can easily use your HSA or FSA debit card to purchase eligible BedJet products. Just add your items to the cart and, at checkout, choose Flex | Pay with HSA/FSA as your payment option. Confirm your eligibility, enter your HSA or FSA card information, and complete checkout as normal.

Don’t have your card handy? No problem—use any credit or debit card instead, and Flex will automatically email you an itemized receipt to submit for HSA or FSA reimbursement later.

HSA/FSA ELIGIBLE PRODUCTS

Free fast shippingFor USA & Canada. All products are in stock and ready to ship.

Free returns for 60 daysIf you're not 100% satisfied, send it back for a full refund.

Free 2-year warrantyWe insure you against anything that goes wrong with your purchase, whether it's our fault or yours.

Free fast shippingFor USA...

Free 10-year limited warrantyPowerLayers are built to last.

Full refunds for 60 daysIf you're not 100% satisfied, get 100% of your money back.

Free shippingShips using standard FedEx/UPS, no freight deliveries.

Free 10-year limited warrantyPowerLayers are built to last.

Full refunds for 60 daysIf you're not 100% satisfied, get 100% money back.

Introducing...

The patented BedJet Cloud Sheet is a performance engineered, luxuriously soft, 100% cotton top sheet designed to work in tandem with your BedJet unit. It's sewn with a series of specially designed interior air flow chambers to help evenly diffuse the BedJet air down onto your body. The Cloud Sheet has the quality of...

FAQ

General FSA/HSA Questions

BedJet has partnered with Flex to allow you to use your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you can now use your HSA or FSA debit card to buy select sound machines and mattresses with pre-tax dollars, resulting in net savings of 30-40%, depending on your tax bracket.

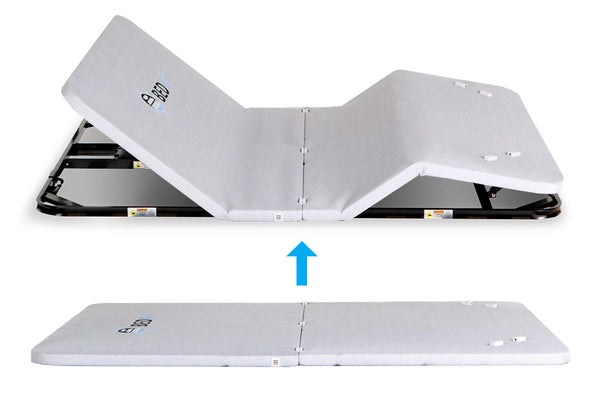

Eligible products include single BedJet 3 systems (new and refurbished), the BedJet 3 Mini, Cloud Sheets, and PowerLayer adjustable bed frames. Dual Zone BedJet systems for couples are not eligible; however, in these cases we recommend ordering the bundle as separate items to allow use of Flex—specifically two BedJet 3 Mini units along with the Dual Zone Cloud Sheet for your bed size.

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card, and complete your checkout as usual. If you don’t see “Flex | Pay with HSA/FSA,” you may be in Shop Pay. Select “checkout as guest” to view more payment options.

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information and Flex will email you an itemized receipt to submit for reimbursement.

Make sure you’re logged out of Shop Pay before checking out. If you’re signed in, select “Checkout as Guest” instead.

An easy way to do this is by completing your checkout in an incognito or private browsing window, which ensures Shop Pay stays logged out and your order processes correctly.

For customers located in Louisiana, New Mexico, and Mississippi, state regulations restrict the use of telehealth services, and Flex is not available in these locations.

HSA/FSA cards are debit cards, and the most common reason for declines is insufficient funds. Reach out to your HSA/FSA administrator to confirm your balance.

Please forward us the request from your FSA, and we will work with the Flex team to issue you a new receipt.

Please check your spam folder, as sometimes emails from notifications@withflex.com may be automatically filtered as spam by some email service providers. If you still can’t find it, please email support@withflex.com and let them know the email address associated with your order

No, unfortunately, this isn’t a supported feature right now. If there are insufficient funds in a single HSA or FSA account, you can instead enter a credit card on the Flex checkout page. You will receive an itemized receipt and/or Letter of Medical Necessity from Flex, which you can submit for reimbursement.

Please contact our Customer Care team for assistance—we’ll review the charges and help resolve the issue right away.

Yes! Sales tax for eligible items is also covered by HSA/FSA funds.

Letter of Medical Necessity Questions

Some products require documentation from a licensed healthcare provider stating that the item is necessary to treat or manage a specific medical condition. If the product requires a Letter of Medical Necessity (LOMN), Flex facilitates a chat-based consultation that generates the Letter in real time.

In order to qualify to use your HSA or FSA card for BedJet products, the IRS requires you to have a Letter of Medical Necessity. BedJet has partnered with Flex to enable asynchronous telehealth visits as part of our checkout. Within 24 hours of your purchase, Flex will email you both an itemized receipt.

You should keep it on file for at least three years in the event of an IRS audit of your HSA or FSA account. Occasionally, FSAs may ask for the Letter to confirm the eligibility of your purchase.

Please email support@withflex.com and they will reach out to their telehealth team to reprocess and send your corrected Letter of Medical Necessity.

Contact our Customer Care team and we’ll reach out to our partners at Flex to see if they can reissue the Letter with an updated date.

Contact our Customer Care team and we will reach out to our partners at Flex and see if we can accommodate your request.

Reimbursement Questions

We strongly recommend checking with your HSA/FSA provider to see if a purchase is eligible prior to completing the purchase. However, if you believe your claim has been wrongly denied, please send over any response from your HSA/FSA provider to us so we can share it with Flex and receive guidance on the next best steps to take. Please note that employer-sponsored FSAs can determine what products are eligible beyond the IRS’s guidelines, so it’s extremely important to check prior to purchase.

The ability to apply for FSA reimbursement in a future calendar year depends on the policy of the specific FSA provider. Most FSA administrators require that the purchase be made during the time of coverage. For example, if the FSA coverage is for 2025, all purchases typically need to be made and/or submitted for reimbursement within that coverage period.

However, some administrators may have more flexible rules regarding the timing of when the expense occurred. We recommend that customers review their plan policy to confirm the details.

Note: Health Savings Accounts (HSAs) are different and generally allow for reimbursement at any time, even in future years.

If your purchase was made without using Flex at checkout, we’re unfortunately unable to provide an itemized Flex receipt or a Letter of Medical Necessity. Some reimbursement providers require this documentation, so if your HSA or FSA administrator requests it, please speak with your healthcare provider for assistance in obtaining a medical necessity letter.